Digital payment as popular Fintech platform nowadays and the worldwide demand for e commerce in this connection has increased more than ever. Research showed that consumers seek for a faster, cost and time effective technology for their day to day personal financial transactions and digital payment was considered an effective supplement to this need. Eventually, people all over the world have phenomenally started to make transition for the conventional payment gateway to have a faster, safer and more comfortable daily life transaction. Fintech also referred to financial technology as a vital financial tool for providing financial services and products. The rapid development of Fintech began in developed countries such as the United States and the United Kingdom. They have potential for growth and financial technology which provided endless financial services and business opportunities, even globally. Recently Asian countries have become leaders while China and India both countries achieved significant growth in the expansion of Fintech. Innovative Fintech in the financial development has changed from single connection to global networks. Fintech improved better in financial services and Gross Domestic Products (GDP) in developing countries. The continuous development in Fintech also brought a variety of financial services to the financial sector, such as mobile payment, internet banking, Crowdfunding, P2P lending and others financial services and products. However, rapid growth of Fintech also established various issues and challenges to the industry especially traditional business model in banking sector.

Fintech innovation in developing country which encouraged economy growths in digital payments, insurance, risk managements and others. Nevertheless, Fintech also flourished in developing countries such as Pakistan, Indonesia and Kenya through cheaper payments systems, digital banking system and others financial services facilities. Furthermore, digital finance improved the financial services to poor individuals and boosted the gross domestic products (GDP) with increased the aggregate expenditures rate. Fintech not only improved the quality of life of individual in developing country but also promoted and created more opportunity on lending system such as Crowdfunding, and P2P lending. At the same times, Fintech encouraged the emerging market and economy growth with upgraded in financial system to globalization level.

Traditional banks applied with their own regulations and laws to their business; Fintech regulations still under the considerations in worldwide. Thus, the bank consistent remained served their existing customer base but Fintech developed wider client network in the market. Furthermore, in the process of Fintech development, individuals and organizations benefited from financial services because of its diversification and development space broader, larger, more convenient and cheaper. Therefore, Fintech not only a patent for developing countries, but also crucial for developing countries. At the same time, developing countries have resolutely established in Fintech start-ups to improve the economy stability and market competency. Conversely, Malaysia banking industry has yet perfected and yet achieved its goal to become a high-level environment. The Malaysian financial sector, including commercial and Islamic banks, has unique elements in the provision of conventional and Islamic products and services. They are the main bridge for economic growth in the financial sector and a vital part of global economic stability for Malaysia market. Consequences, the disruptive nature of Fintech innovation has prompted the traditional banking industry changed the financial system in order to continue competed in future.

The Pros and Cons of Fintech

As we knew, the word “Fintech” derived from the words financial and technology which referred to technology supported in financial solutions. There were close relationship between financial technology and financial services. Fintech evolutions involved in few decades of evolutions and affected wider in connection of finance and technology. Fintech has a long history and evolved through the traditional business model to modern trend. In this session discussed about the four stages of Fintech evolutions and further explored on Fintech innovation of Fintech 3.5. Fintech 1.0 as first stage of Fintech evolution, which started since early 1866. The first transatlantic cable and Diners Club credit was credited in this period. This was also the first period people started financial globalization business by using basic technology such as telegraph and railways. Development of Fintech continued to second stage which was Fintech 2.0. Fintech has significant growth from traditional way to digital finance. A more comprehensive and advancement on digital financial services began at this period. Rapid growth of Fintech during Fintech 3.0, Fintech innovations involved emerging markets in both developed and developing countries. The new era of Fintech evolutions not only affected the traditional banking and also others financial institutions. Furthermore, Fintech innovations involved in wholesales and retails business development. Today, people talked about the Fintech start-ups, presented challenges for regulators and identical market participants. The Fintech evolutions not only affected the individual, organizations and country on daily activities but also to global business. The evolutions of Fintech started from the retail, wholesale, trading and slowly transformed the traditional business models in financial services which affected financial institutions, lastly the global finance.

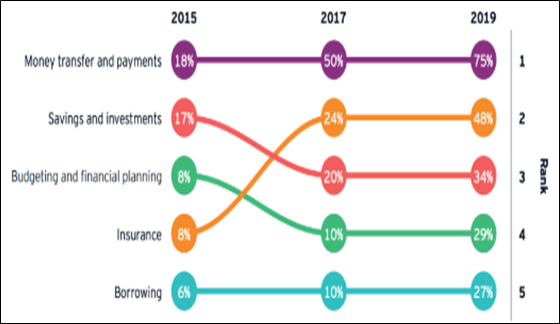

Figure 1.1

Comparison Financial Segments Adoption Rate (2015 – 2019)

Sources: EY’s Global Fintech adoption index 2019

According to World Bank report, the reason of Fintech adoption rate kept increasing around the world which Fintech provided cheaper, faster and profitable than traditional institutions. Asia country has rapid growth in financial industry especially China and India. In year 2019, China and India became the top Fintech adoption country among 27 countries included US, UK, Australia, Singapore, Germany and others. Both countries reached 87% of total consumer in Fintech adoption market. Besides that, Fintech start-ups in multiple financial products which 4,000 Fintech companies in USA and UK with total invested amount more than $24billion globally. In 2019, developing countries such as Southeast Asia (Singapore, Thailand, Indonesia, Vietnam, Philippines, Malaysia and Myanmar) which has raised $993million across 1244 rounds for Fintech start up purpose. The Fintech adoption in financial services segments showed, the highest usage was 75% on money transfer and payment segment and followed by insurance segment which was 48%. Both of the segments has significant positive growth from year 2017 to 2019. Savings and investment segment at 34%, budgeting and financial planning segment at 29% and followed by borrowing segment at 27% for year 2019. The survey showed that the financial services segments has rapid growth during five years period as Figure 1.1 as above (Ernst & Young, 2019).

The Fintech emerging market mostly involved risk management, set management, payment, regulatory technology and others financing activities. USA was the largest Fintech adoption country in emerging market, followed by UK, India, Canada and China. However, the real life in Alipay and Yu’E Bao as significant successful sample to prove the China was the lead of Fintech in global channel. When developed country grew in Fintech, developing country also affected. Fintech innovation in financial services on mobile devices such as ATMs and smartphones on payment method started in Southern Asia since earlier 1980s. Besides that, Fintech start up in Indonesia in payment services growth rapidly and globalized recently. While year 2017, Indonesia reached highest adoption rate in digital payment system according Bank Indonesia (Indonesia Fin Tech Association Data, 2017). All the statements above showed Fintech has positive significant affected in financial services in emerging market. Thus, in-depth observations and advance research on the relationship between Fintech with digital payment should be explored. In addition, in Sweden and Finland, banks more interested in researched, created and improved the communication networks due to new market needs. The confidence level of customers on payment services motivated the banks to develop in Fintech services and products. Customers’ trusted on banks higher compared to other financial institution. Therefore, combined the traditional banking system with innovative financial technology was essential to provide customers with the best financial services.

In Malaysia, Bank Negara Malaysia (BNM) showed that local banking industry could be affected by Fintech, estimated 10% to 40% coming 2025 (Malaysia’s ex-centre bank Governor, Dato Muhammad Bin Ibrahim stated in his speech in the Global Islamic Finance Forum 5.0). Therefore, the challenges and risks of evolution by Fintech was significant affected the local financial industry. This motivated for the research to determine the impacts of Fintech to the region in multilevel of financial services. Meanwhile, the Financial Sector Blueprint 10 years plan drove Malaysia to become a developed nation in 2020. Malaysia former Prime Minister, Dato’ Sri Mohd Najib given a message on Financial Sector Blueprint 2011, urged that the Malaysia’s financial sector potential to become potential new economy model with innovation, creativity and high value added organizations. The objectives of Malaysia 10-year Financial Blue Print launched at year 2011 was strengthen the financial system towards high-income and high value-added country (Bank Negara Malaysia, 2011). Financial institutions such as local banks, Islamic banks and other financial institutions played an important role to transform efficient, speed and improving the competitiveness in global markets.

Today, Fintech was not a new topic with provided financial technology advancement in financial sector across the world. Recently, the Fintech 4.0 has been arose in talked and influenced in the worldwide business. Hence, it has become a crucial study and research in depth on the impacts of Fintech after a few decades’ evolutions. The financial sectors referred to banks, investment banks, mortgage, insurances companies and others financial institutions. Financial services also involved Blockchain, Artificial Intelligence (AI) or Big data and technology ecosystem furthermore alternative online lending segment (Board of government, Washington, 2016). Although Fintech evolution in payment system drove to rapid growth in financial industry but it also disrupted financial sectors on continuous development. Digital payment such as Blockchain has been used as digital assets and property transferred rights across the countries. This activities has unclear boundaries that needed to be clarify further weather created a new business opportunities in financial services in business development. Digital payment mostly focused on bank industry with disruptive issues such as payment infrastructure, misused, usage data protected and regulations.

Moreover, innovations and new practices of financial technology disrupted the traditional banking system and the nature of financial services in the market according to newly financial crisis. Traditional banks operated with own legal policy with their old customer based conversely Fintech innovative created opportunity and flexibility to grow wider customers based with loosen regulations. Obviously, traditional business model especially banking industry needed to change and reorganized their operations system to continue compete in market in this new technology market. At the same time, Fintech innovation created the markets with heighten financial technology advancement compared to traditional to become more promptitude. Simultaneously, when all the financial transactions depended on technology, there also led to the risk. Therefore, Regtech start-ups was crucial on regulations and protected the Fintech activities between consumers and providers. Consequences, Regtech played an important role on guidance, monitoring and proper reporting on Fintech usage. After 2008 financial crisis, Fintech regulations and restricted guideline aimed to protect personal data and information disclosure in financial services industry. Thus, Fintech has contributed the advantages and disadvantages in financial sector compared to traditional financial sector management of business development process. Although Fintech created new business opportunities and facilities on transmission information across the countries but the products and services provided by Fintech can be challenged to the traditional business especially traditional banking sector.